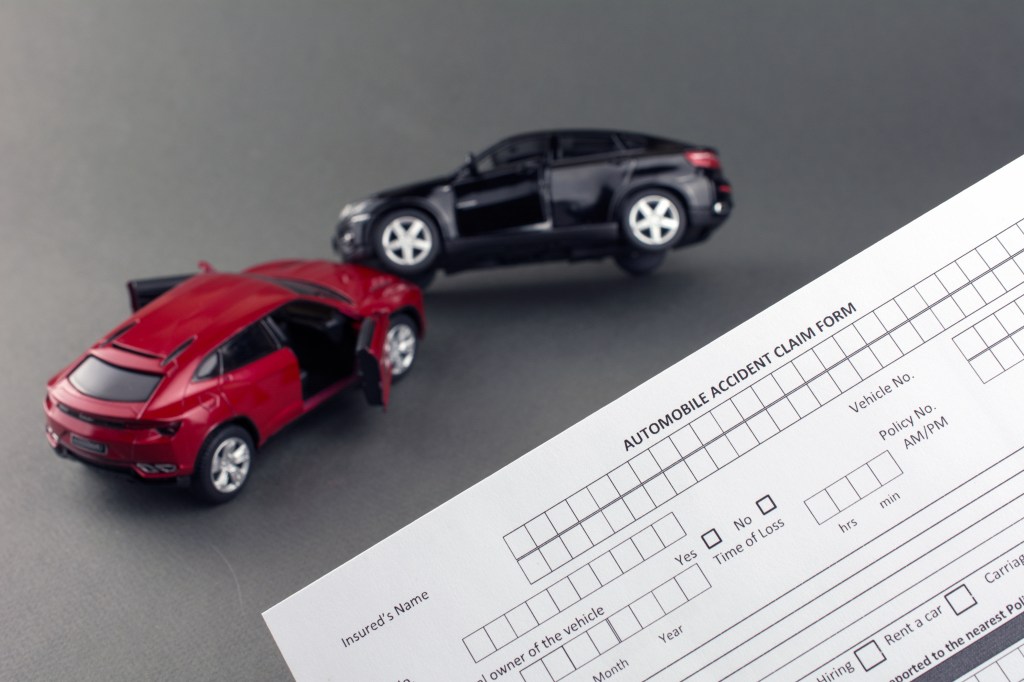

Business Auto Coverage Games

A corporate owner or officer wants to insure his personally owned auto on the company’s Business Auto Policy. Heck, he wants to insure all the family vehicles under the BAP! Or how about this one…a corporate owner wants to rent a car, loan it to his daugher’s boyfriend for the summer, and insure under the…