Are You Missing Opportunities to Cross Sell?

According to Insurance Thought Leadership, it costs a business seven-to-nine times more to acquire a new customer than to retain a current client. So why aren’t today’s agents focusing more on cross-selling? This article examines ways to cross sell, with a thorough list of cross-sell coverage opportunities.

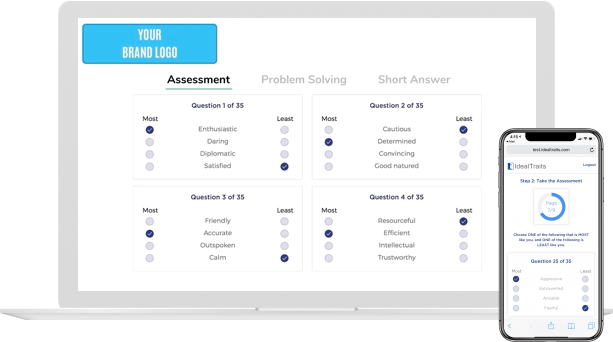

Author: Nancy Germond There are plenty of reasons to cross sell, but how do agents find the time and talent to do the outreach needed to place new business for current customers? As recently as 2019, the estimated cost to an independent agency to acquire a new client was $900, according to Insurance Thought Leadership. Cross-selling a current customer costs a lot less. What is Cross Selling? Let’s define cross selling. Cross-selling occurs when you market to and sell new products to existing customers. For example, your customer with her home and auto with you may be a strong prospect for an umbrella policy, especially if you learn she just installed a pool. Or your auto only customer may need a tenant’s homeowner’s policy but doesn’t realize that it not only covers his belongings but can protect him for liability arising out of his frequent golf games. Today’s consumers want easy access to everything. By lacking technology for online quoting and an inability to meet the demand for almost instantaneous inquiry responses, many agencies today are outpaced by their larger competitors. Many agents today focus heavily on social media outreach to acquire new customers. However, agents can effectively use social media to cross-sell to existing clients with the right social media campaigns and by creating a loyal customer following. Why Cross Sell? There are at least five solid reasons to cross sell to your current clients.

You don’t want to be that agent who only calls your clients if a problem arises. Taking the opportunity to call or reach out via email at birthdays, special occasions like holidays, or other times can build your relationship with your existing customers, making you less reliant on the harder hunt for new clients. Coverages You Can Cross Sell Here are just some of the coverages you can review with your customers to validate their coverage needs. Commercial Lines

Personal Lines

Life & Health

With a little brainstorming with your other producers, you can no doubt expand that list. As early as 2006, Allstate began urging its agents to cross sell life and health. My father started his insurance career, which spanned over 50 years, in life insurance. However, as he focused more on writing commercial and personal lines coverage, he brought in an agent who specialized in life and health. We’re not suggesting if you lack experience in life and health that you jump in with both feet. Consider partnering with another agent who specializes in life and health coverage to help keep another life agent, perhaps that captive agent right down the street from your insured, from cherry picking your clients. Direct writer/captive agents offer many other coverages in addition to life insurance. You know the old saying about letting a camel’s nose in the tent. Once the nose in in, pretty soon the whole darn camel is in your tent. Tips About Cross Selling As a producer, you may feel you don’t have time to cross sell. Consider having your customer service rep do the heavy lifting. Just ensure only licensed agents reach out to your customers to discuss coverage. It may be acceptable for an unlicensed insurance staff member call to set an appointment, but only licensed agents should talk coverage specifics. Next, document your conversation to protect youself, and follow up by email or in writing. You never want an insured saying, “You never told me higher limits were available” when they’re hit with an underinsurance or coinsurance issue, or “You never offered me that coverage. I don’t have coverage for my claim. I would have bought that coverage if you’d offered it [no matter what the price!].” Consider your target market. If you sell to a retirement community population, chances are they may need life insurance for their children, because if something happens to one of their kids, they may face raising grandchildren. Or if you have a solid book of bar and tavern business, it might be worthwhile to review your book and ensure you’ve offered and documented assault and battery coverage. And of course, all your insureds now face escalating costs associated with rebuilding a damaged property, so part of your cross-sell techniques should include discussing property and business income values. Next, don’t push. Simply ask questions, such as these.

This documents your conversation and helps protect you against allegations of professional negligence. You can develop an agency template you can use repeatedly that will reduce the number of keystrokes you’ll need to document your conversation. Cross selling is a great way to add value to your existing book of business without incurring the costs associated with new client acquisition. Finally, premium increases and coverage availability is now impacting the entire U.S. consumer base. Why not reach out to your former customers with a simple postcard or mailing inviting them back? Of course, screen out those clients where you breathed a sigh of relief at their departure. Changing agents often not a good experience for many consumers. The grass is not always greener on the other side. It may take only a nudge to havethose former customers return. Last Updated: October 31, 2024 _______________________________________________________________________________________________ Copyright © 2023, Big “I” Virtual University. All rights reserved. No part of this material may be used or reproduced in any manner without the prior written permission from Big “I” Virtual University. For further information, contact [email protected]. |